#5things: Before The Bell

Treasury Secretary uncertainty, US exceptionalism, Tesla pops, Uranium glows

Every couple has their love language. My husband says mine has become sending passive-aggressive DMs to him on Instagram. I send videos about how women need more sleep than men and why it is more important for dads to play with their kids. What he calls “passive-aggressive”, I call efficient communication. I’m simply giving him some reading material for his 30-minute bathroom breaks.

Round trip: US markets are back to where they were before Donald Trump got elected. There are all sorts of reasons for this unwind: stretched valuations, typical sell-the-news behaviour, and a more hawkish tone from the Federal Reserve. A few hedge fund managers claim there is another reason: tensions about who will be the next Treasury Secretary. Right now, it is a face-off between Scott Bessent (CEO of Key Square and Trump advisor) and Howard Lutnick (CEO of Cantor Fitzgerald and key Trump fundraiser). Hedge fund manager Kyle Bass over the weekend said Bessent is “eminently more qualified than Howard Lutnick to run the US Treasury.” Elon Musk retorted that Bessent “is a business-as-usual” candidate and prefers Lutnick. Bass suggested the reason the market is selling off is because the odds of Bessent becoming Treasury Secretary are falling (see chart). As I said, there is a laundry list of reasons why the markets pulled back last week. This is possibly one of them. This morning, futures are mixed. Tesla’s strength is helping to offset weakness in Nvidia. Nvidia shares are down because The Information is reporting their new AI chips are causing servers to overheat. Gold is rising for the first time in seven sessions, even while the US dollar is still rallying. This week we get Walmart (Tuesday) and Nvidia (Wednesday) reporting results. In Canada, we get inflation tomorrow and retail sales on Friday.

(via Dan Clifton, Strategas)

Friends in high places: Shares of Tesla are up 6.5% right now after Bloomberg News reported that Donald Trump’s administration will make self-driving cars a priority. “Musk's significant influence in the Trump White House is already having a major influence,” wrote Dan Ives at Wedbush, “and ultimately the golden path for Tesla around Cybercabs and autonomous is now within reach with an emboldened Trump/Musk strategic alliance playing out in real time.” Ives has a street-high price target of $400/share. Tesla has obviously benefitted from the buddy-buddy relationship between Musk and Trump, but what about Alphabet which already has self-driving cars on the road through Waymo? The contrast is stark. Tesla shares are up more than 30% since the election. Alphabet is actually down 4.5% since the election. Ives says autonomous driving is worth $1 trillion alone to Tesla. What is it to Alphabet? Alphabet shares have zero reaction to the Bloomberg report. Alphabet also happens to trade at 21x forward earnings vs Tesla’s 131x.

Positively glowing: Uranium stocks are higher this morning. Late Friday, Russia said it would temporarily limit enriched uranium shipments to the United States. Shares of Cameco, NexGen Energy, Uranium Energy Corp, Denison Mines and Energy Fuels are all higher in the pre-market. While Russia did not give a specific reason as to why they were limiting supply, President Biden signed legislation in the spring that would ban Russian enriched uranium. However, exceptions were in place until 2028. Russia’s decision now could be a bargaining chip ahead of the incoming Trump administration.

Follow through: Newmont Mining is higher this morning after announcing the sale of one of its mines and hitting its $2 billion asset sale target. This morning Newmont announced it is selling its Musselwhite mine in Ontario to Orla Mining for up to $850 million. Newmont will us the proceeds to support a $3 billion buyback. Once this sale is approved, Newmont will have made good on its promise to sell $2 billion in assets after its purchase of Newcrest last spring.

US exceptionalism: If it feels like the US markets are taking up a lot of ink these days, it is not your imagination. Here are three stunning charts that show how dominant the US markets have become as they are poised to put in back-to-back 20% annual moves. The US market cap as a percent of world market cap is now over 50% for the first time since Bloomberg started tracking the data in the early 2000s. “The US Continues to eat the world when it comes to stocks,” notes the folks at Bespoke Investment Group.

Magnitude of US outperformance relative to global stocks (via Sara Eisen, CNBC)

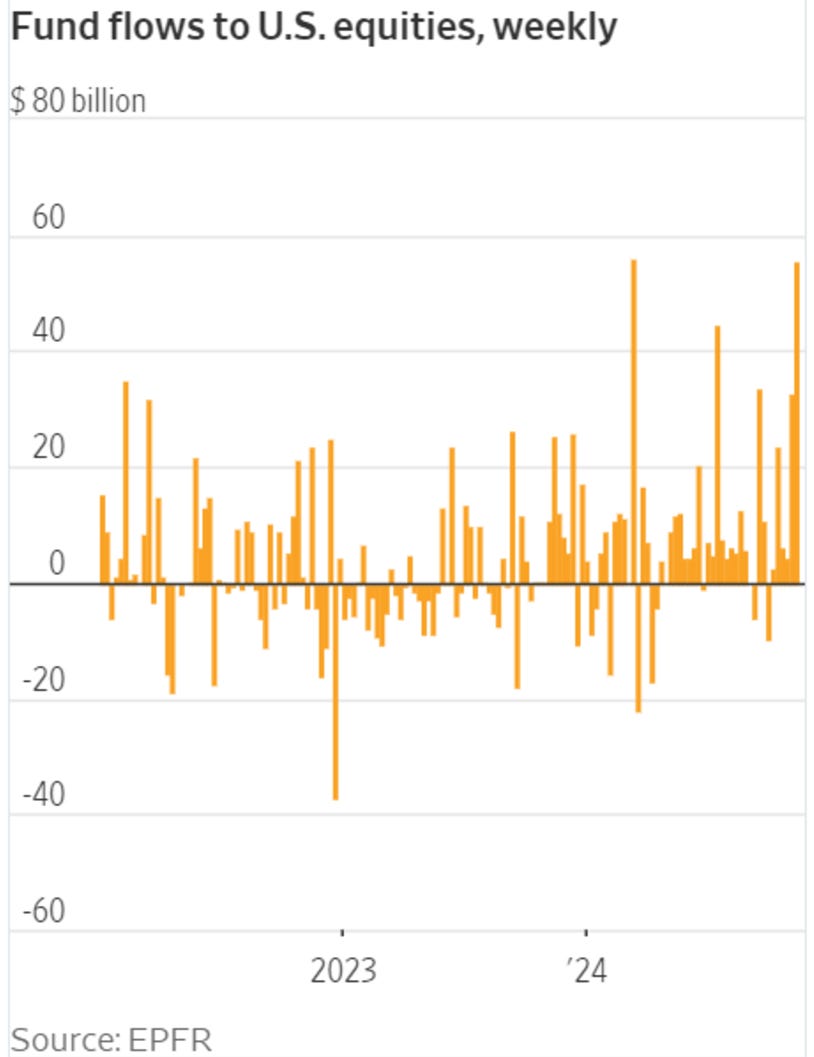

Fund flows into US stocks hit second highest level on record ($56 billion)

Quite interesting watching two shameless, self promoting, businessmen prepare to run The US.

X has been an awful business experiment for Elon (financial metrics heavily support this statement) — and promotes his own speech over free speech, yet touts the platform as a free speech paradise.

We are all hypocrites; we simply vary in our degrees of hypocrisy. I must say the hypocrisy of Elon runs very high these days.

I wish the best for our southern neighbour, however Trump and Elon may be great at business — geopolitics is an entirely different ballgame that both these men have a very poor track record with.

Time to get out the popcorn and enjoy the show ahead 🍿

Thanks Amber for the great analysis to start the day 🙏

Great insight! When is Alphabet going to get some respect from investors? It’s one of our club’s top holdings. I was in Phoenix recently at the Arizona State University campus and Waymo taxis were everywhere. Preferred by students. No awkward conversations with Uber drivers such as being asked if you live alone. Driverless taxis are going to be huge in cities.