In the Money: 5 Things to Know

Industrials talk tariffs, Novo's stock diet, Icahn buys Bausch stake, Aritzia upgraded, Barrick Gold sheds assets

My husband is back after a week-long business trip to Asia. The jet lag is killer. Poor guy couldn’t make it through bedtime with the kids. Luckily though, it cleared up right before the hockey game last night.

Should you buy the dips or stick with relative strength? The answer is a bit of both according to Liz Miller of Summit Place Financial. She has been managing money for 20 years and seen her fair share of cycles. The art is about picking the right stocks to chase lower and knowing which ones to stay away from. Don’t miss this actionable-packed interview. Tune in! Listen on Apple, Spotify or here.

This newsletter is sponsored by BMO InvestorLine. The newsletter and the podcast may give you some interesting investment ideas. To help you research and potentially act on those ideas, consider BMO InvestorLine. Their platform provides the resources you need to analyze potential investments, with the valuable tools and research you need when exploring the market. Plus, you’ll find the BMO Investment Learning Centre with educational courses and videos empowering you to make informed decisions. Learn how you can earn up to $3,500 cash back when you open a new account.

Rebound: Futures are higher this morning indicating a recovery from the sell-off yesterday as the “sell America” trade was full-on: sell stocks, sell US dollar, sell bonds. This morning, the dollar is finding its footing even as gold continues to new record highs. The TSX was clipped despite the rally in gold in broad down day with nearly 70% of the index down yesterday. Positive talk around trade with India is helping to lift market spirits this morning. Earnings take over with 30 S&P 500 companies reporting today, including Tesla after the bell.

Industrialized: The industrial sector is helping to brighten the mood this morning after better than feared earnings lift stocks. Shares of both 3M and GE Aerospace are now higher after initially selling off post-earnings. 3M is popping 4% in the pre-market after sales and profit beat expectations. The maker of Post-it notes and Scotch tape also maintained its full-year profit forecast, bringing relief to investors who are worried about its supply chain exposure in China. Having said that, the company did say tariffs would clip profit by about 5% in a worse-case scenario. Shares of GE Aerospace are getting a 3.5% lift in the pre-market after beating profit expectations and maintaining its profit outlook. Unlike 3M, GE’s outlook does include a hit from tariffs however they are offsetting it by finding $500 million in cost savings. Defense stocks are a little more of a mixed back. Lockheed Martin shares are popping 3.5% after earnings beat and it maintained its profit outlook. However, the outlook does not include the impact of tariffs. On the flip side, shares of RTX and Northrup Grumman are lower after highlighting how tariffs would weigh on their bottom line.

Health check: Shares of Novo Nordisk are plunging 10% in the pre-market after rival Eli Lilly showed strong results from its obesity pill. This is stoking fears that the Ozempic-maker is going to steadily lose market share. In fact, we just had Rob Moffat of Middlefield on the show saying he would buy Eli Lilly over Novo for that exact reason (35:45). In other health news, shares of Bausch Health are surging 14% in the pre-market after the company said Carl Icahn has accumulated a 34% “economic interest” in the embattled pharma company. This has been achieved through direct share purchases as well as equity swap agreements. This would make Icahn the largest individual shareholder, surpassing John Paulson of Paulson & Co fame (who is also Chair of the board). The former Valeant is finding itself in the grips of hedge funds once again against a backdrop of tumult. It has crushingly high debt ($21 billion), has faced legal challenges over its patent of IBS drug Xifaxan, and has been unable to complete the separation of its eyecare division Bausch + Lomb. I don’t think many Canadians think about this name any more but something in this mess has piqued the interest of Carl Icahn.

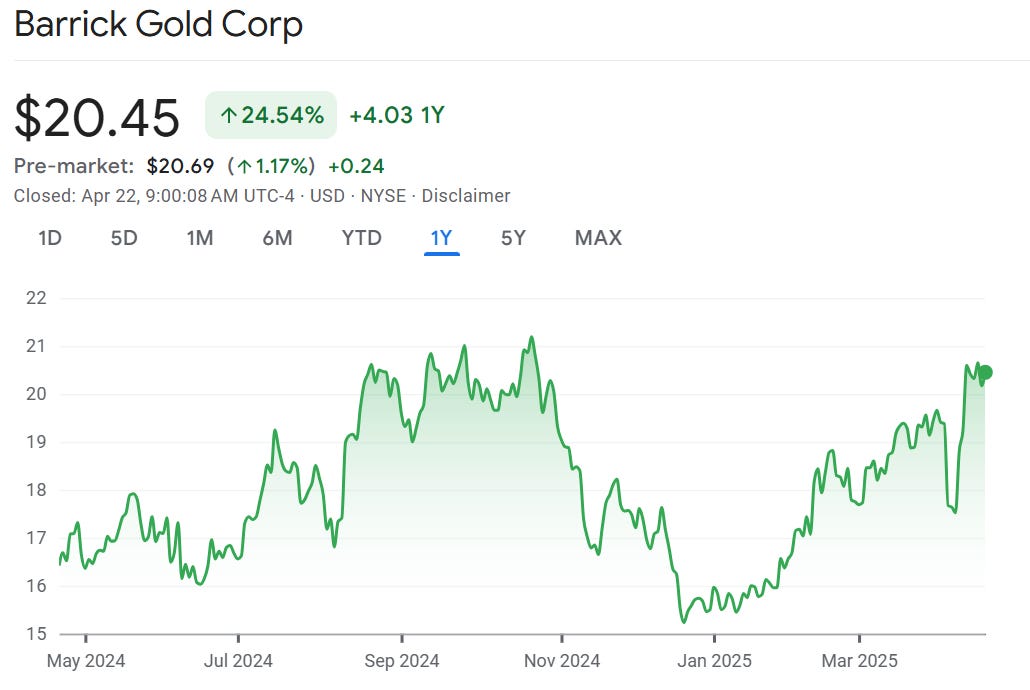

Sell high: Barrick Gold announced this morning that it is selling its stake in an Alaskan mining project for $1 billion to Novagold and John Paulson. Paulson is a top shareholder in Novagold. The price Barrick got is higher than expected. “This sale price is well above the $600mm we currently carry for the stake in our (net asset value),” wrote TD’s Steven Green, “We view this project, which is in the permitting stage and not in their immediate development pipeline, as non-core for Barrick.” Barrick’s CEO Mark Bristow touted the deal’s attractive valuation. “This is a good example of an instance where an asset we own might be better suited in the hands of others, while we pursue our priority portfolio of Barrick-managed growth projects,” said Bristow.

Notable calls: Raymond James is upgrading shares of Aritzia this morning after a 40% drop in the stock. “While still hard to predict, we would anticipate that as tariff and trade-related noise eases (we hope), we believe investors will quickly gravitate back to the stock given the growth opportunity still in front of the company,” wrote Raymond James’ Michael Glen. Target price is $55/share which implies 30% upside from here. CIBC is downgrading shares of Canfor and Doman Building Materials this morning. Canfor is already trading at the lowest level since the pandemic, but the downgrade suggests investors shouldn’t buy the dip. Goldman Sachs is downgrading Macy’s citing too many negative catalysts. “While we remain constructive on the company's growth initiatives, we believe these are likely offset by slowing GDP growth, tariff risk, and inflationary pressures,” wrote Goldman’s Brooke Roach.

Get your questions in now! Email questions@inthemoneypod.com

My wife can identify with your opener:)

We’re LOAO here after I read your opening comment to my wife!

I hope you save all these snippets and (others you may not have shared) and one day do a book on: My Family, My Life …. in bits and bites. 😂🙏🏽

Ps: I haven’t even read your business news as yet! LOL!