In the Money: 5 Things to Know

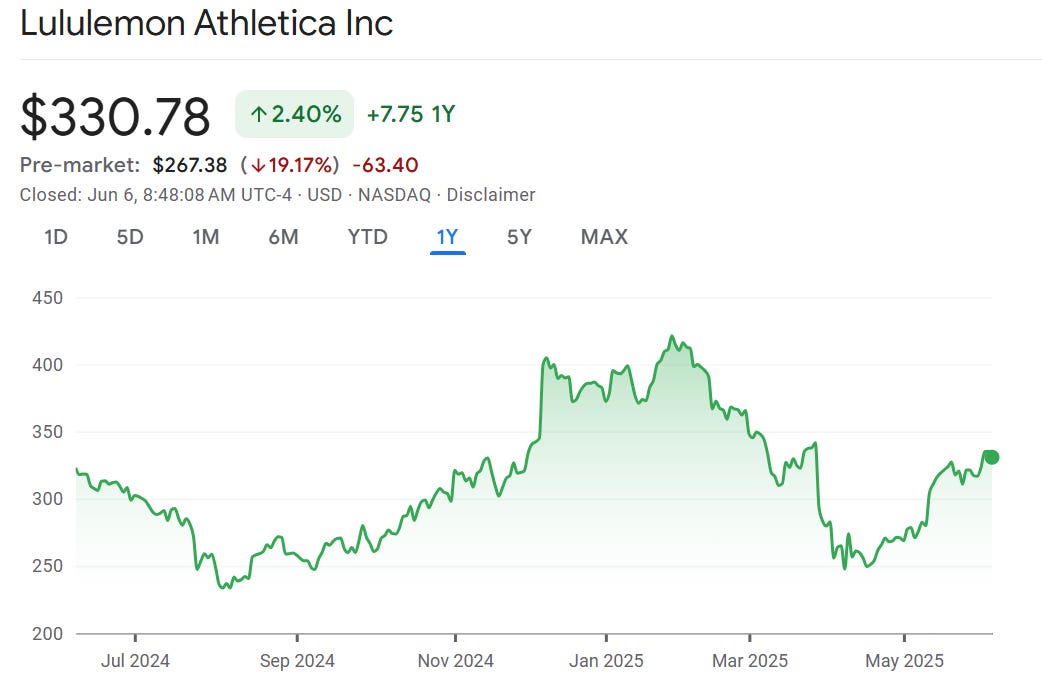

White House drama, Canada & US add more jobs than expected, Lulu plunges, Broadcom fails to impress

Today Child 2 is instructed to wear “old clothes” to school while Child 3 has “fancy day.” They go to the same school. This cements my belief the teachers are doing their part to make us wish summer break so this madness can come to an end.

Watch the full episode: Distress, disruption, and unloved assets: Is now the time to dig where others aren’t looking? In this episode of In the Money with Amber Kanwar, seasoned investor Daniel Lewis, Managing Partner of Orange Capital, shares his contrarian playbook about hunting for opportunity in orphaned stocks and distressed markets.

We are never getting back together: It is not every day you see a sitting President and the world’s richest man behave worse than children in a schoolyard. The breakup between US President Donald Trump and Elon Musk was on full display yesterday with both trading insults. Trump threatened to take away all subsidies sending shares of Tesla down 14% while Musk said Trump was in the Epstein files. “Yesterday’s spat between Elon Musk and President Trump sucked all the oxygen out of the room,” wrote Bespoke Investment Group. Before the spat the markets were trending higher because of positive trade developments with China. “We believe cooler heads will prevail today and into the weekend (hopefully),” wrote Dan Ives at Wedbush. “We will be monitoring the situation closely today but we believe Tesla shares are way oversold on this news as this spat between Trump and Musk does not change our firmly bullish view of the autonomous future looking ahead that we value at $1 trillion alone for Tesla.”

Jobs in Canada: Canada unexpectedly added 8,800 jobs in May vs consensus expectations for 10,000 job losses. However, the unemployment rate hit 7% - the highest since the pandemic and the highest since 2016 when you exclude the pandemic. In Ontario, the unemployment rate hit 7.9% which is the highest since 2012 outside of COVID. Since February, Canada has lost 15,300 jobs and the gains today are less than what is needed to keep up with population growth. “The Canadian labour market continues to weaken, albeit for now only gradually,” wrote CIBC’s Andrew Grantham. The details weren’t all bad. Full time employment drove the gains, while part time declined. The public sector shrank on the wind down of election workers. “While today's data were not quite as bad as expected, there's still signs of slack gradually building in the labour market which supports our call for a return to interest rate cuts at that July meeting, albeit admittedly with a lot more data and tariff news still to come before that decision,” Grantham said.

Jobs in the US: Futures are rallying on the back of better than feared job growth in the United States. Our southern neighbours added 139,000 jobs last month vs the expectation for 126,000. The unemployment rate held steady at 4.2%. The better than expected job growth also means traders are paring back their bets for a rate cut by the Federal Reserve this year. However, the markets are taking comfort that the US economy is still churning out jobs and growth isn’t evaporating. Yields and the US dollar spiked on the print.

Downward dog: Shares of Lululemon are plunging 19% in the pre-market. Quarterly results missed expectations for the second month in a row and the athletic apparel retailer also cut its profit forecast. The company says tariffs have raised the cost of production and this could lead to a significant reduction in profitability. They do plan to raise prices on some of their goods with the CFO saying they are planning “strategic” price increases. Raising prices is a tricky balancing act right now. The CEO of Lululemon said the US consumer is “cautious” on the conference call. To be clear, the company is still growing. Total sales advanced more than 8%. But the pace of growth has been slowing for several years now despite the CEO’s pledge to double sales. International growth was weaker than expected this quarter. Stifel called this international deceleration a “surprise” but had confidence in the US women’s business.

Chip check: Shares of Broadcom are down about 3% in the pre-market after results failed to live up to lofty expectations. Keep in mind the stock recently hit an all-time high. The chip-maker beat profit and sales expectations with the topline increasing 20%. The outlook the company provided was weaker than expected despite strength in its AI pipeline. “There isn’t much recovery in the legacy businesses,” wrote Morgan Stanley.

Email your questions to questions@inthemoneypod.com!