In the Money: 5 Things to Know

Futures perk up, Canadian retail sales plunge, Strathcona stands by MEG offer, gun sales down, Olive Garden owner to hit record

It was my turn to host my neighbourhood cookbook club and I gave in to all my worst instincts. The theme was butter. It wasn’t enough to cook with it, I made everyone wear yellow. When one of my friends was getting ready in the requisite butter yellow uniform her husband remarked, “Has anyone said out loud that you are dressing like the food?” Butter yellow is this summer’s Barbie pink, but don’t bother with it now as we officially did it to death Wednesday night.

Watch full episode: U.S. stock valuations may look stretched but veteran strategist Brian Belski isn’t worried. In this episode of In the Money with Amber Kanwar, the Chief Investment Strategist at BMO Capital Markets shares why he’s still bullish on U.S. equities, but warns that now more than ever, stock picking matters.

Precocious: US stock futures are indicating a tentatively higher open after markets were closed yesterday for Juneteenth. The TSX was open and traded lower, but on much lower volume than normal due to America’s day off. Today investors are taking comfort in the idea that the US will take its time in deciding whether it is going to be dragged into a war with Iran. The White House said US President Trump would make his decision in two weeks to allow time for diplomacy to win out. Crude is pulling back slightly from a 5-month high. We also got comments from Federal Reserve Governor Christopher Waller who indicated the Fed could begin cutting rates as soon as July (right now October is fully priced in). Futures got a lift on the back of those comments this morning. Also this morning: Canadian retail sales dropped by the most in a year. Retail sales for April declined more than estimated (-0.3%), but the flash estimate for May suggests a 1.1% plunge. “Looking through the tariff- and gas price-driven swings, the retail sales report points to slowing consumer spending through the spring. The weak flash estimate for May, even if largely auto-driven, is consistent with our view that the economy struggled in the second quarter,” wrote BMO’s Shelly Kaushik.

Go with the flow: Strathcona says they stand by their offer for MEG Energy but welcomes the board’s effort to see if there is another bidder. “Strathcona looks forward to participating in the strategic alternatives process which will also provide an opportunity for MEG’s board to learn more about Strathcona, something which it

has declined to do to date,” Executive Chairman Adam Waterous said in statement. MEG is currently trading above Strathcona’s offer price, so investors are betting on either a sweetened offer or another bidder. SPECIAL PROGRAMMING ALERT: In the Money with Amber Kanwar is going to the Calgary Stampede and will do an episode in front of a live studio audience featuring Adam Waterous. Don’t miss it! Have questions for Adam? Send them to questions@inthemoneypod.com

Gun shy: Shares of Smith & Wesson are plunging 13% after sales dropped more than expected and profit fell. Apparently tariffs, inflation and higher interest rates are weighing on gun sales. Not great if you are a shareholder, but works out if you like humanity.

Extra breadsticks: Apparently tariffs, inflation and higher interest rates are having no effect on Olive Garden restaurant goers. Shares of Darden, the parent company of Olive Garden and LongHorn Steakhouse reported better than expected comparable sales growth (+4.6% vs 3.5% expected) and unveiled a $1 billion buyback. The stock is poised to open at a record high. The outlook for sales was a little softer than anticipated, but that is mainly due to the closure of some restaurants says TD’s Andrew Charles rather than slowing demand.

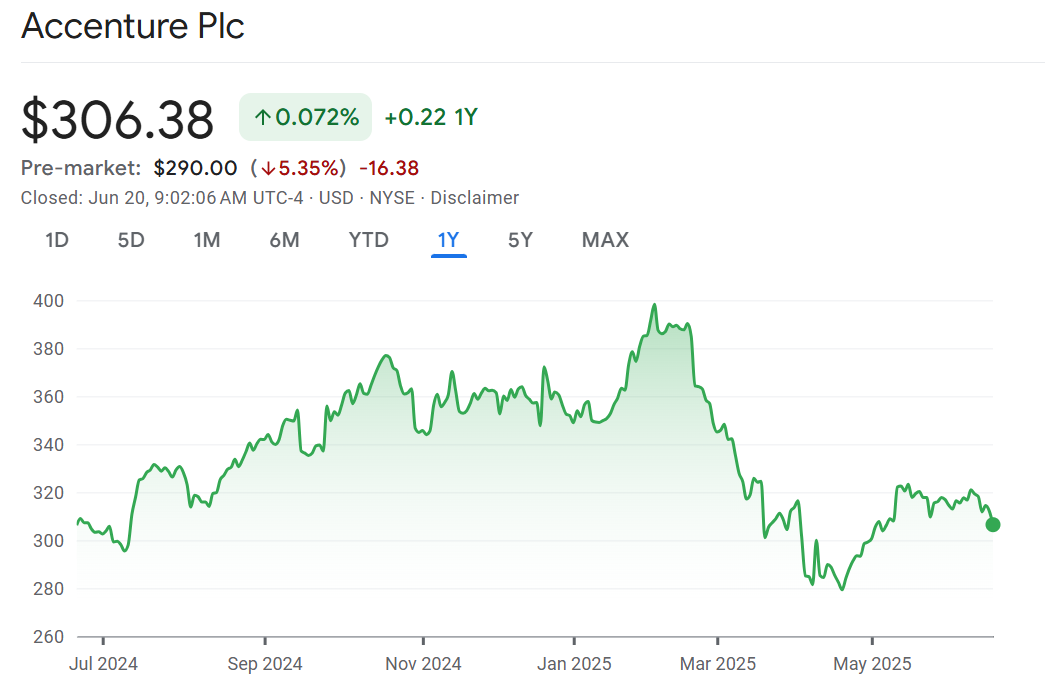

Pls fix: Shares of Accenture are under pressure after bookings dropped more than expected. The IT services and consulting company saw bookings drop 7%, stoking investor anxieties about a weak IT spending environment (outside of AI, of course) that was exacerbated with DOGE’s government spending cuts. The stock has underperformed, down 12% so far in 2025. Even though Accenture boosted its sales forecast for the year, investors can’t seem to look past the weak booking growth. Still, most analysts rate this a buy with RBC’s Dan Perlin noting that its AI bookings reached $1.5 billion (out of $19.7 billion).