In the Money: 5 Things to Know

Futures under pressure, Boeing crash, Oracle surge, Papa John's takeout, notable calls

Thank you to everyone for your well wishes on our anniversary. We enjoyed a lovely dinner at 5:45pm and were in bed by 10pm. If that is not goals after 9 years I don’t know what is.

Cole Smead of Smead Capital Management did not hold back in his return to In the Money with Amber Kanwar. After presciently suggesting MEG Energy could be a takeout candidate in March, he returns to the show and drops another combination he could see by year end. He explains why he thinks commodities, including Canada’s energy sector, are going to outperform the S&P 500 over the next five years. You can listen on Apple, Spotify or here.

Unnerved: US stock futures are indicating a lower open this morning after US equities closed in the red yesterday. Canadian markets fared better with the TSX closing at an all-time high. A combination of geopolitical tensions and trade uncertainties are weighing on the markets. Yesterday’s better than expected consumer inflation in the US was overshadowed by threats from Iran about targeting US bases in the Middle East. This was a headwind for US stocks, but a tailwind for Canadian stocks as oil rallied nearly 5%. There is a bit of give back this morning. US President Donald Trump undid optimism around trade in China with a new post that said letters will be going out to countries setting unilateral tariffs ahead of a July 9th deadline. The gap between US stocks and Canadian stocks is getting wider. While the S&P 500 is close to all-time highs, it is up only 2% at the mid-point of the year. The TSX, on the other hand, is at a record high and has notched a respectable 7% so far this year.

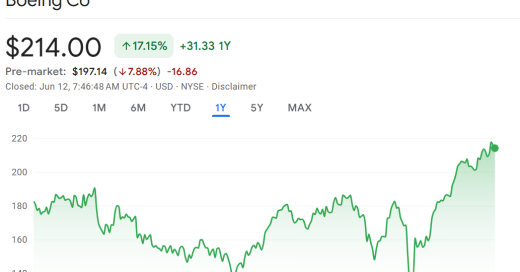

Crash in India: Shares of Boeing are plunging nearly 8% this morning as details about an Air India plane crash are starting to emerge. A Boeing 787-8 Dreamliner carrying 242 people headed for London crashed a few minutes after taking off from India. The number of casualties are still coming in and as of the last total, 30 people have been killed. This is the first recorded crash of a Dreamliner and the plane appears to be about 11-years old. The cause of the crash is still unknown. For investors this will pick at anxieties about Boeing’s abilities to make planes that don’t crash. If this is caused by a defect of the plane, this will be the third such fatal crash since 2018. Boeing’s issues began in 2018 when a Lion Air Flight using a Boeing 737 MAX 8 crashed and killed everyone on board. Then a few months later an Ethiopian Airlines Boeing 737 MAX 8 crashed killing all passengers. This lead to the plane being grounded for more than a year. Boeing was in recovery mode when the pandemic hit and the stock plunged even further. Then in January last year a door panel flew out mid-flight reigniting concerns about Boeing’s manufacturing. There are still too many unknowns to draw any conclusions about this tragic incident but obviously investors aren’t waiting around. Shares of Boeing suppliers GE Aerospace (-3%) and Spirit AeroSystems (-3%) are falling on the news.

As prophesized: Shares of Oracle are surging 8% and poised to open at record highs after quarterly results came in well above expectations and it forecasted better sales. Total sales in the quarter increased 11% but revenue from its cloud infrastructure business jumped by 52%. This is where all those AI dollars are pouring into. Oracle says that unit in particular is poised to grow 70% this year. The only blight on the quarter was that it burned $3 billion in cash when analysts were expecting $3 billion in cash generation. Spending on capital expenditures has tripled from a year ago as they invest in keeping up with AI demand. “We believe the strong outlook suggests ORCL should see benefits materialize from large mega-AI projects such as Stargate,” wrote Citi’s Tyler Radke about the join venture between Oracle, Softbank and OpenAI which aims to build up America’s AI infrastructure.

Did someone order takeout?: Shares of Papa John’s surged midday on unconfirmed reports of private equity interest. Apollo and Irth Capital reportedly have made an offer to buy the company in the low $60s/share according to reporting by Semafor. “In our opinion, an offer in the low- $60 range would be compelling for existing investors,” wrote Stifel Chris O’Cull in a note to clients. He’s still not willing to recommend shares here because of issues with the company. “While there may be opportunities for a financial buyer to engineer a better cost structure by taking the company private, we believe the primary issue with the company's performance has been its struggle to establish a compelling position that allows it to compete effectively against the scale advantages and strong price-value proposition of the category leader,” he wrote.

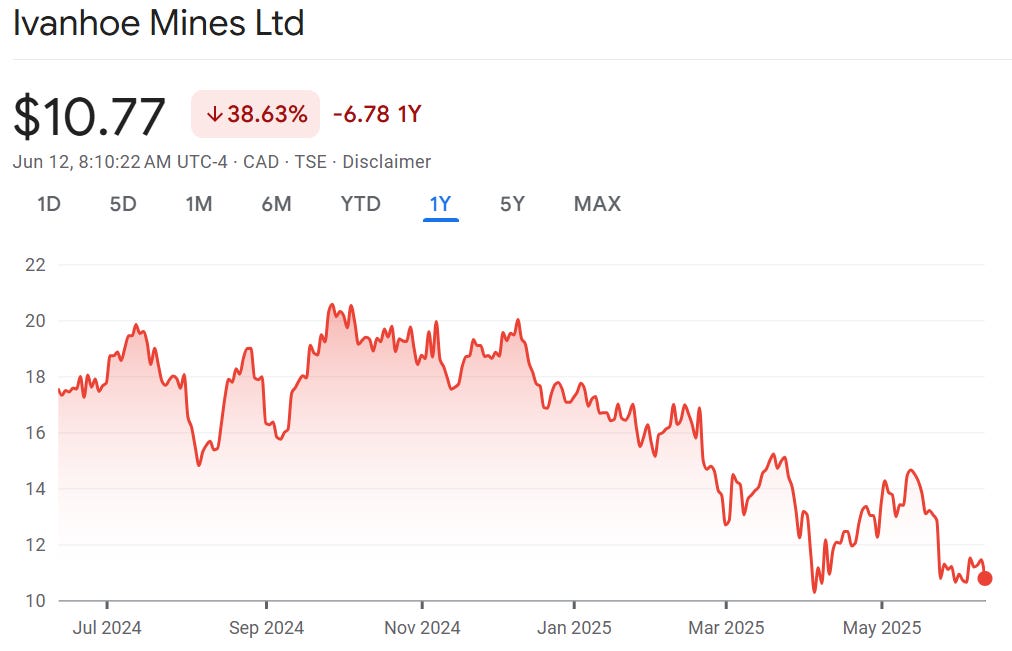

Notable calls: Shares of Ivanhoe Mines could come under pressure after slashing its forecast for copper production as it restarts a flooded mine and was downgraded at Scotia. Ivanhoe says production will be will be lower at its mine in the Congo after restarting parts of its operations that were hit by flooding. Scotia’s Orest Wowkodaw downgraded the stock calling the update “materially weaker than anticipated.” Watch shares of Atkins Realis after it caught a downgrade from National Bank’s Maxim Sytchev. The downgrade is notable because Sytchev has never had anything but a buy rating on the stock - even when it was called SNC Lavalin and embroiled in a federal scandal. So why now? “Downgrading to Sector Perform as positives are well understood; limited M&A (net asset value) accretion potential and margin gap vs. peers (at now similar valuations) requires some consolidation at current levels,” he wrote. Stifel has started covering Cargojet with a buy rating (disclosure, I’m a long suffering shareholder). “The stock is trading at a 10-yr low valuation,” wrote Stifel’s Daryl Young of the cargo airliner. “Looking forward, we think the valuation will grind higher as tariff/trade deals are cemented and a more cyclical freight recovery materializes,” he said in the note. His price target is $125/share suggesting nearly 30% upside from here.