In the Money: 5 Things to Know

Waiting game for stocks, crude advances, vaccine stocks, Casey's beat, Taiwan Semi

The house is scrambling to get out the door this morning, we’ve got Child 3’s graduation ceremony. Yes, I’m one of those millennials who thinks every milestone should be celebrated - including graduating from pre-school. I’ve noticed that the days are getting easier as the kids get older, but there is a part of me that wishes the hardest years of my life would slow down and last a little bit longer.

Veteran investor Ross Healy has been navigating markets for 60 years — and right now, he’s sounding the alarm. In this episode of In the Money with Amber Kanwar, Ross explains why he believes U.S. stocks are dangerously overvalued and could be facing a major correction. Find out where he is finding safe harbour. You can listen on Apple, Spotify or here.

Waiting to exhale: US futures are flat after a mostly flat North American session yesterday. Investors are waiting for any tangible trade developments between the US and China as trade negotiations enter their second day in London. Tomorrow we will get a key read of US inflation for May that will give us a sense of how much tariffs drove up prices. It’s a thin week for earnings but tomorrow morning we will get results from Dollarama and later in the week results from Adobe and Oracle.

You’re fired: Keep an eye on vaccine makers this morning after RFK Jr decided to “retire” the 17 members on the Advisory Committee for Immunization Practices. All members will be replaced after RFK Jr. accused the current members of being compromised. While this would appear negative for the sector it is worth noting that stocks like Merck and Pfizer are flat right now. “Although today's announcement introduces some new uncertainty for the sector, we underscore for investors that this likely represents more headline risk than a true fundamental change at the agency,” wrote BMO’s Evan Seigerman. Stocks like Merck and Pfizer have underperformed the market on polticial risks. “While RFK Jr.'s commentary surrounding vaccines has been consistently critical, we believe this has been well established with realistic headwinds largely priced in by the market,” wrote Seigerman. There are some bright spots in pharma this morning. Shares of Novo Nordisk are catching a bid this morning after the Financial Times reported an activist investor has built a stake in the company. I’ll temper my enthusiasm having already run into the failing arms of Pfizer with hopes an activist could turn things around there. That caveat aside, the activist here (Parvus Asset Management) is hoping to have influence over selecting the new CEO. The size of their position is still unknown and it is important to keep in mind the way Novo is structured (a foundation controls most of the voting), it makes it very difficult for an activist to effect change through voting.

Energized: Crude oil is advancing for a fourth session in a row and trading at a two month high. At $65/barrel it is still far from robust price, but it is enough to make the entire sector perk up. Crude bottomed on May 5th and has rallied nearly 15% since then but the oil producers on the TSX are up about 20% since then. Is this a head fake or the start of a new recovery? We will get perspective from Cole Smead of Smead Capital on the podcast this week. He was on in March and was prescient in his call that MEG Energy was a takeout candidate. We’ll get his updated thoughts. If you’ve got questions about the energy sector, email us questions@inthemoneypod.com

Ride the wave: Shares of Taiwan Semiconductor are popping 2% in the pre-market after May sales came in strong. Revenue surged 40% in May from the year before although it was a slower pace than the 48% growth seen in April. With this monthly intel it looks like sales for the quarter are coming in ahead of consensus expectations. AI is likely part of the story, but we won’t know until results come out. “We honestly don’t know what drove the strong monthly sales, but still find that encouraging amid uncertainties brought by tariffs,” wrote Bernstein’s Mark Li.

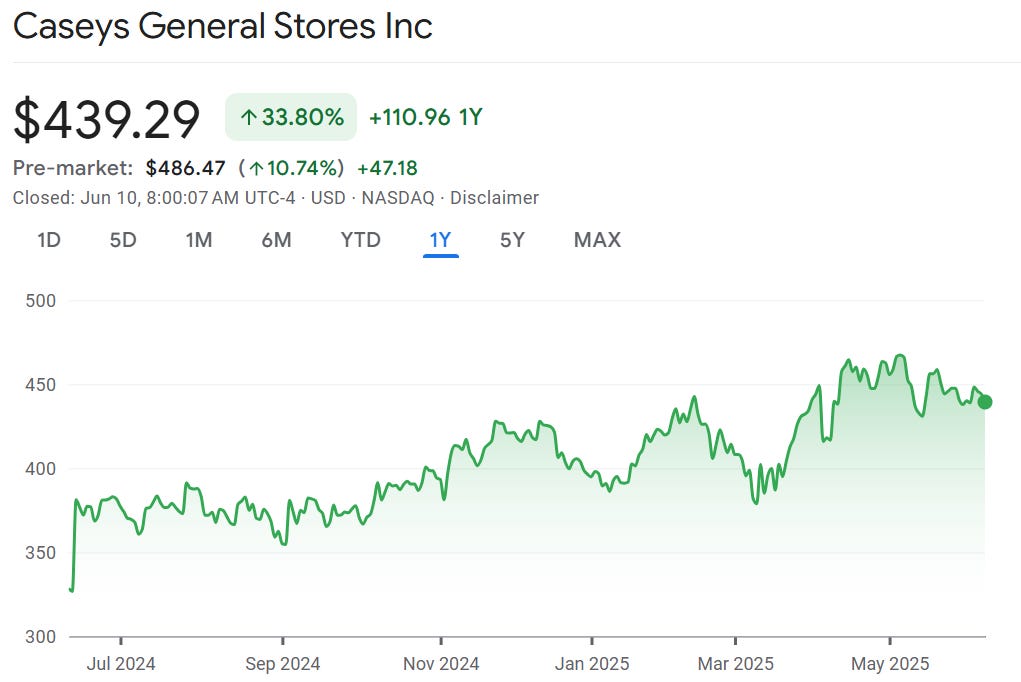

At the general store: Shares of Casey’s General Stores are surging nearly 11% in the pre-market and poised to open at an all-time high this morning. The gas station and convenience store operator posted profit that was 40% higher than expected on the back of higher fuel margins. Grocery and prepared food sales came in a little lighter than expected. “Inside same-store sales tepid relative to forecast/prior Q’s, likely reflecting consumer spending pressure, notably from lower income cohorts, and weather,” wrote RBC’s Irene Nattel. A premium valuation keeps Nattel on the sidelines, but even she acknowledges the results were strong. “CASY continues to earn its valuation premium, underpinned by attractive inside-store mix, unit growth cadence, geographic concentration, strong opex controls,” she wrote.