In the Money: 5 Things to Know

Futures resilient, MEG rejects Strathcona, Parkland gets green light, Sarepta halts trials, Nippon gets thumb's up from Trump

War in the Middle East, G7 meeting in Canada and Fed rate decision...everything you need to know about the trading week in my Globe column.

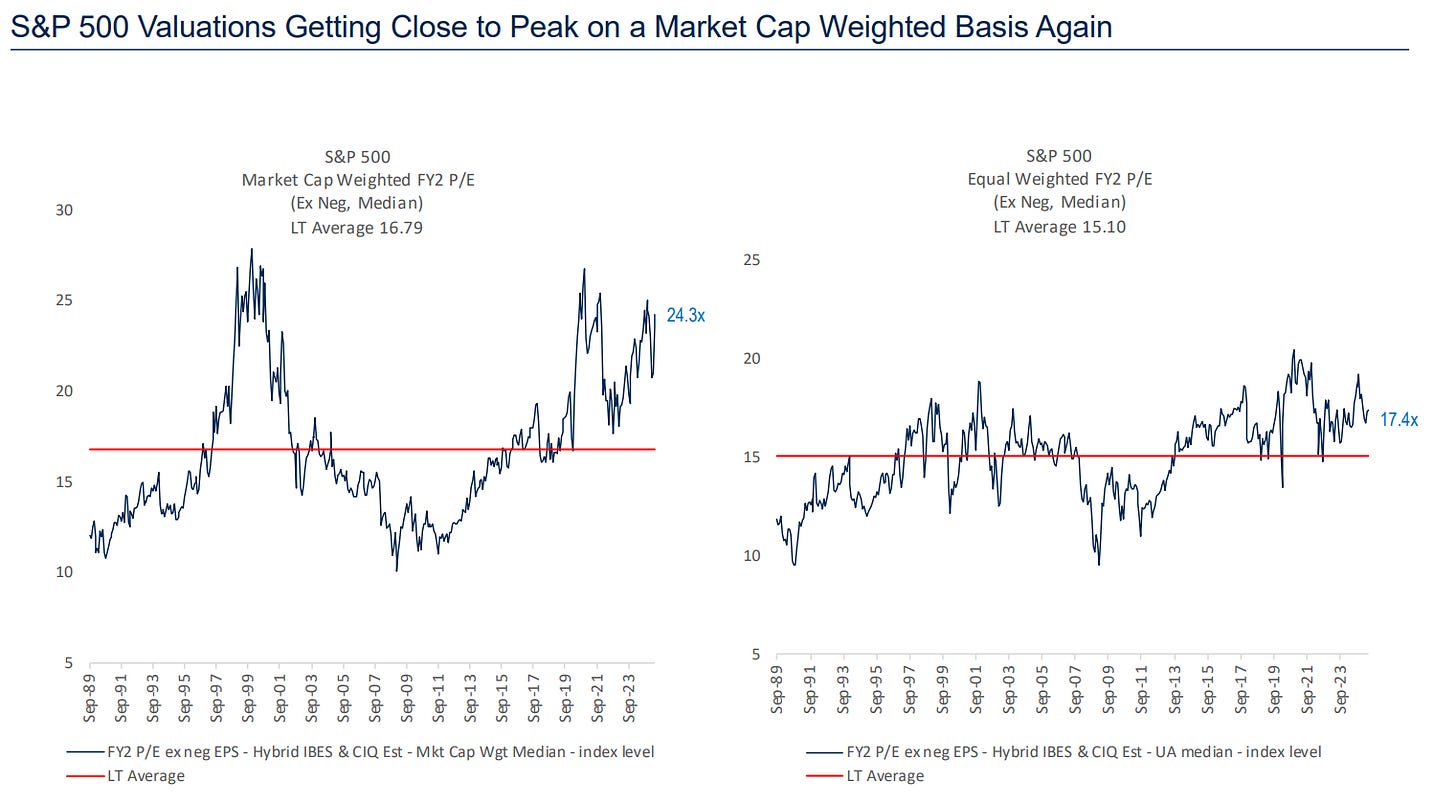

Climbing the wall of worry: US futures are indicating a higher open and oil is retreating as dip buyers take advantage of Friday’s market wobble. Israel is continuing its attacks in Iran for a fourth day in a war that could reshape the Middle East. Yet, investors seem to be moving on with oil pulling back 1% this morning. Still, crude is firmly above $70/barrel and that is reigniting inflation concerns. “…At a time when inflation is already highly in focus for other reasons, we are concerned about the potential for upward pressure on oil prices,” wrote RBC’s Lori Calvasina in a lengthy 138 page report this morning. She warns that higher inflation would be a drag on multiples which is her primary concern when it comes to the market. The report details how stretched valuations are for the S&P 500 relative to history, even when you neutralize the mega cap tech weighting (see chart below).

In play: MEG Energy has officially rejected Strathcona’s hostile offer to buy the company and says it will pursue a review of “strategic alternatives.” MEG called Strathcona’s offer “inadequate” in a surprise to no one given MEG is trading above Strathcona’s offer. Now the real fun begins. Will another bidder emerge? Recall, we spoke with shareholder Cole Smead on the podcast last week who says he believes Strathcona will sweeten its bid and be successful in buying MEG.

Thumbs up: In other deal news, Parkland says proxy advisory firms ISS and Glass Lewis endorse Suncoco’s purchase of the company. They both called the deal “compelling” with ISS highlighting there is also no competing offer. Investors will likely reluctantly vote this one through after the largest shareholder, Simpson Oil, said they would be voting for it. However, many will be doing so reluctantly. Just last week, Ross Healy told us Parkland is being stolen and that the offer is inadequate.

Halted: Shares of Sarepta are plunging 40% after a second patient died of liver failure while being treated with their key drug leading the company to pause their clinical trial. Sarepta makes a gene therapy that is designed to treat Duchenne muscular dystrophy. This affects young kids and many die in the their 20s. It is understandable that there was tremendous hope around this drug. A few years ago the drug was approved through an accelerated and controversial decision in which a divided advisory committee narrowly voted in favour of the approval. In fact, staff objected to the approval but the FDA overrode their concerns. The deaths have been in patients who were non-ambulatory (unable to walk). The program for the drug is continuing in ambulatory patients (able to walk). However, investors are faced with a second death and a pause on the program. BMO is downgrading the stock this morning noting that while management could still turn things around, it will likely take the stock time to recover.

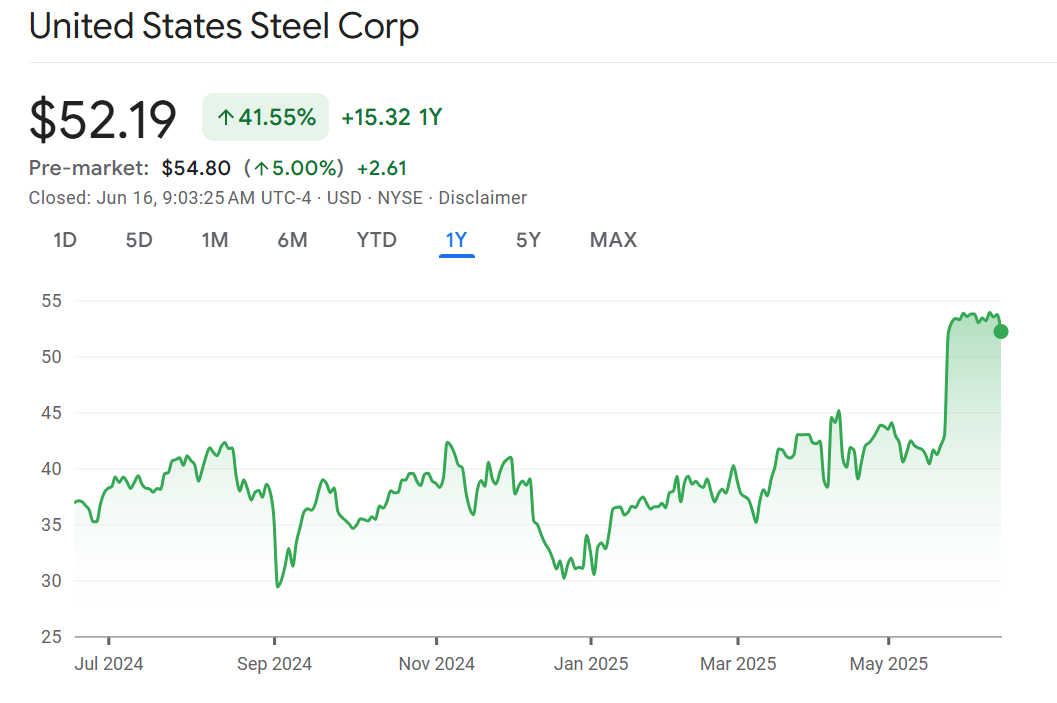

Golden deal: Nippon Steel has officially secured approval from US President Donald Trump for its $14.1 billion takeover of US Steel. It’s a wild conclusion for a deal that looked dead in the water under the Biden administration. While it may seem incongruous for an “America-first” President to greenlight a deal to sell an American bellweather to a Japanese company, Trump applied pressure to get terms he was happy with. This includes a “golden share” that gives the US government say in major decisions.