In the Money: 5 Things to Know

US markets closed, loonie spikes on WSJ report, Canadian oil stocks & tariffs, $TRUMP

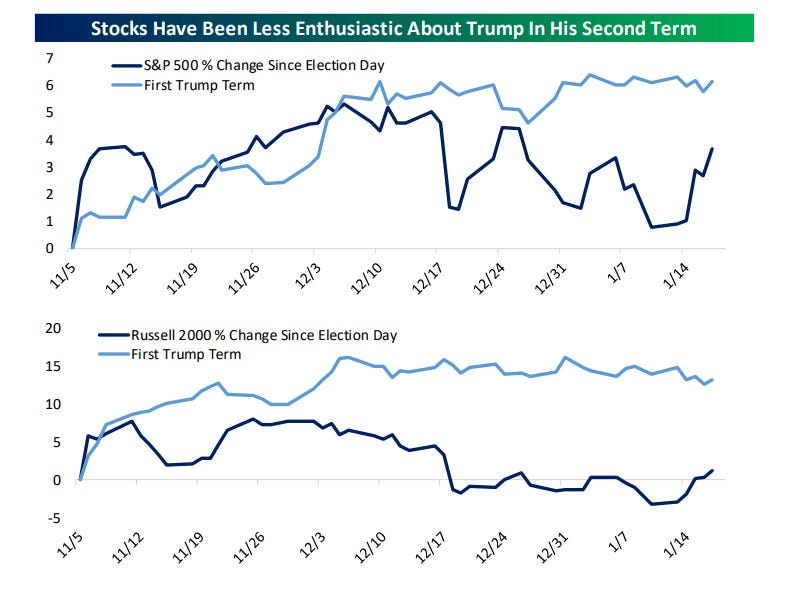

Calm before the storm: US markets are closed today due to Martin Luther King Jr. Day. Coincidentally, Donald Trump’s inauguration is also taking place this morning at 11:30amET with executive orders expected to start flying after that. In 2017, Trump issued 55 executive orders in his first year in office and 220 in total according to Jim Reid at Deutsche Bank. Today, we could get 100 in a single day. Canada is directly in his sight lines, but perhaps will be unscathed today (more on that below). It is perhaps fitting that on the day of President Trump’s inauguration the markets just put in their best weekly showing since the election. However, second time around the markets aren’t as enthusiastic as they were last time, points out Bespoke Investment Group. The chart below shows large cap stocks have gained less and have been more volatile while small caps are barely up compared to a 13% rally at the same point in 2017. Enjoy the silence today because things start to rachet up this week. In Canada, we will get the Bank of Canada outlook survey later this morning, inflation on Tuesday and retail sales on Thursday. In the US, we get key earnings from Netflix, Johnson & Johnson, Procter & Gamble, and Travelers. We will also get global headlines from the annual pilgrimage to Davos for the World Economic Forum. Trump is expected to speak virtually later in the week.

Developing: The Canadian dollar is surging 1% right now on reports from the Wall Street Journal that Trump won’t impose new tariffs yet. Instead he will authorize a broad memo to study trade policies. We are seeing an initial sigh of relief in currencies that could extend to other sectors like energy (more on that below). However, the report also makes clear that this is still very much top of mind and the memo reportedly puts Canada and Mexico on noticed ahead of the review of NAFTA 2.0 in 2026. The memo reportedly says federal agencies are going to assess NAFTA 2.0 and its impact on American workers and businesses and make recommendations regarding America’s participation in it. This ain’t over folks!

Tariffied: The price of oil is up 15% in the last three months and trading at $78/bl but Canadian oil producers haven’t budged. Why? One word: tariffs. Today the entire industry is on edge waiting to see if the pledge to impose 25% tariff on all imported goods will apply to crude oil and natural gas. RBC says the prospect of tariffs on Canadian energy “is not a zero-probability event.” Canada accounts for 60% of imported oil into the US. Needless to say putting tariffs on the sector would be damaging to the American economy because it would increase the cost of energy. Rather than retaliate, RBC says “better to let an ill-designed policy weigh on its architects.” What does this mean for stocks? RBC says there are no winners, only relative losers. “Integrated oil companies such as Suncor Energy (about 40% of its crude oil is exported to the US) and Imperial Oil are partially insulated via their retail distribution networks in Canada. BP would be the most exposed of the global major…” wrote the analysts. However, they also see opportunity noting the group has already partially priced in the impact of tariffs. Canadian energy infrastructure stocks might be the place to hide out according to Maurice Choy at RBC. They like Altagas, TC Energy, South Bow and Enbridge here. This morning I am sitting down with Eric Nuttall, prolific Canadian energy investor at Ninepoint Partners, to find out what he is buying and what he is selling in this environment. The episode will come out tomorrow morning!

Momo: The TSX is off to a sluggish start in 2025, underperforming US and global markets. Under the hood, there may be opportunities notes technical analyst Javed Mirza at Raymond James. For long-term investors he recommends taking a look at Brookfield Infrastructure Partners and Sandstorm gold which are displaying improving to accelerating technical trends. For a bigger pick-up look at B2Gold, BRP, Fortis, Maple Leaf Foods, Vermilion, and TD Bank which were displaying deteriorating trends but are now improving. For those looking for short-term trades he recommends checking out the improvements in Barrick Gold, BCE, Telus, Imperial Oil, Linamar, and Cargojet.

$TRUMP: You could have invested in the S&P 500 in the last 50 years or you could have invested in Trump Coin in the last 72 hours and the outcome would have been the same. Donald Trump launched his own meme coin over the weekend and it is now valued at $46 billion (including all shares, not just shares available for trading). Expect this coin to be super volatile (it is down 35% as of this writing). Interestingly, one of the catalysts for the selloff was that Melania Trump unveiled her own meme coin (now worth $8 billion) which soared. What a time to be alive. The crypto community is going nuts over the signal this is sending. Bitcoin has surged to a fresh record high. The network Trump launched his coin on, Solana, also surged to a record before pulling back slightly this morning.

Nuttal is a typical Bay St. group think talking head that never admits when he's wrong!

Well written, seems to me that Canadian eyes should be shifting to NAFTA renegotiations rather than imminent tariffs