In the Money: 5 Things to Know

Futures higher on trade hopes, Cameco surges, Simpson gives thumbs up to Parkland Deal, RBC downgrades InterRent, Children's Place plunges

Don’t miss my new weekly column in The Globe and Mail discussing the major market catalysts for the week. From Apple’s World Wide Developer Conference (and what it means for the stock) to US inflation (and the fight between the Fed and Trump) we’ve got you covered!

Cuppa: US futures are higher on hope that trade talks between the US and China today in London will help to diffuse tensions. There are signs of progress .China approved some exports of rare earths over the weekend. With the S&P 500 closing above 6,000 on Friday for the first time in February, Wall Street strategists from Morgan Stanley, Goldman Sachs and Citi are all talking up the markets with Citi increasing their year-end price target to 6,300. Oil prices are continuing to advance this morning and energy stocks helped the TSX hit three all-time highs last week. Over the weekend there were changes announced to TSX index with RB Global (the former Ritchie Brothers) being added back starting June 23rd after being booted two years ago. Algoma Steel, Precision Drilling, Tilray and Spin Master will be deleted and could come under pressure in today’s session. There were no changes made to the S&P 500 index, but stocks that were hoping for inclusion are under pressure this morning: Applovin (-3%), Robinhood (-4%), Carvana (-2%), Ares Management (-2%). Today watch defense stocks as The Globe and Mail is reporting that Canada is set to announce a large increase to defense spending. Prime Minister Mark Carney will announce plans to spend 2% of GDP on defense in the next year and above those levels in future years.

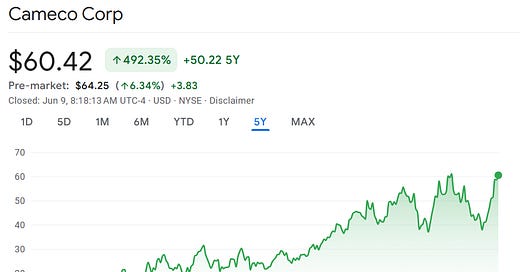

Glowing: Shares of Cameco are soaring 6% in the pre-market after saying that profit at its nuclear consulting unit Westinghouse, which it owns 49% of, will be higher due to construction of two nuclear reactors in the Czech Republic. Price targets are moving up across the board this morning. Keep an eye on shares of Atkins Realis this morning. The engineering consulting firm says it has signed a collaboration agreement with France’s largest electricity company. The stock closed at an all-time high Friday after announcing it had closed the sale of the 407 toll highway. “The stock is not the "table pounder" it was at that time, but we still have a positive disposition moving ahead,” wrote Ian Gillies of Stifel.

Good enough: The largest shareholder in Parkland says it will vote in favour of a deal to sell to Sunoco. Simpson Oil, which owns just under 20% of Parkland, says selling to Sunoco will allow Parkland to benefit from “first-class management” after languishing under “lamentable governance and performance issues.” While activist investor Engine Capital said they plan to vote against the deal, given Simpson’s position size this effectively allows the transaction to go through and ends years of activist fighting. Recall, Sunoco swooped in to buy Parkland just days before it looked like Parkland’s board was going to lose a proxy battle.

Notable calls: BMO is being downgraded at Barclays in a post-earnings season note. BMO shares are within spitting distance of all-time highs and it appears the downgrade is based mainly on valuation. InterRent was downgraded at RBC with the analyst saying the REIT is unlikely to receive a “materially superior offer” to buy company other than the one put forth by the Chair. Recall, InterRent agreed to a takeover by the Chair at $13.55/share. The stock initially traded above that price on hope someone else would swoop in, however it settled at exactly the offer price on Friday. “…There is a reasonable probability of a modestly sweetened offer to get the deal to the finish line,” wrote RBC’s Jimmy Shan in the downgrade. Tesla was downgraded to hold at Baird noting the stock did well even during a “fundamentally poor quarter.” The reason for that was optimism around robotaxis, but Baird says comments by Elon Musk on the robotaxi ramp are “a bit too optimistic.” The elephant in the room of course is the very public breakup between Musk and US President Donald Trump. The spat has added “considerable uncertainty” to the Tesla story, wrote the analyst.

Messy place: Shares of Children’s Place are plunging 24% in the pre-market after it lost more money than expected and sales dropped nearly 10%. The interim CEO is blaming it on the “current retail environment” including “the tariff situation.” However, it is clear strategic missteps are also at play. E-commerce sales plunged after the company raised its free-shipping minimum to $40 from $20. It’s a big win for the shorts - nearly 44% of the shares outstanding are short!

Looking forward to Ross Healey episode

Got to love Ross Healey, I would like his thought on Mark Carney speach on miliary spending and is there any Canadian defence stocks i should be looking at maybe CAE or MDA ??? thank you Amber