In the Money: 5 Things to Know

Tariff delay, Palantir rockets higher, Spotify pops, Merck plunges, TMX beats

We all know about “the boy who cried wolf”. It seems we are living a real-world “the boy who cried tariffs.” Those who did exhaustive research yesterday are just plain exhausted this morning. Don’t be surprised if one month from now, I just send out the exact same note I did yesterday.

Don’t miss this timely episode of In the Money with Amber Kanwar. We speak with investor Barry Schwartz about why he ignores the tariff noise, why he steers clear of Canada for the most part, and where he is finding opportunities right now. Listen on Apple, Spotify, or here. YouTube will be out later today.

Moot: Futures are tentatively higher this morning after breakthroughs between the US, Canada and Mexico took the threat of tariffs off the menu for another month. Canada was able to secure the delay by promising to invest more to fight organized crime and drugs, appoint a fentanyl czar, and designating drug cartels as terrorists. So let’s all meet back here in a month. We can see the relief in Canada. The Canadian dollar is back to where it was on Friday. Canadian-based companies are higher in the pre-market including Canada Goose (+2%), Magna (+3%), and Shopify (+2%). Yet futures aren’t ripping higher because China has fired back with retaliatory tariffs against the US on certain energy sources. Focusing on earnings seems downright mundane even as there are 43 companies reporting today including Alphabet, AMD and Snap after the bell today. We will take a look at the biggest movers below.

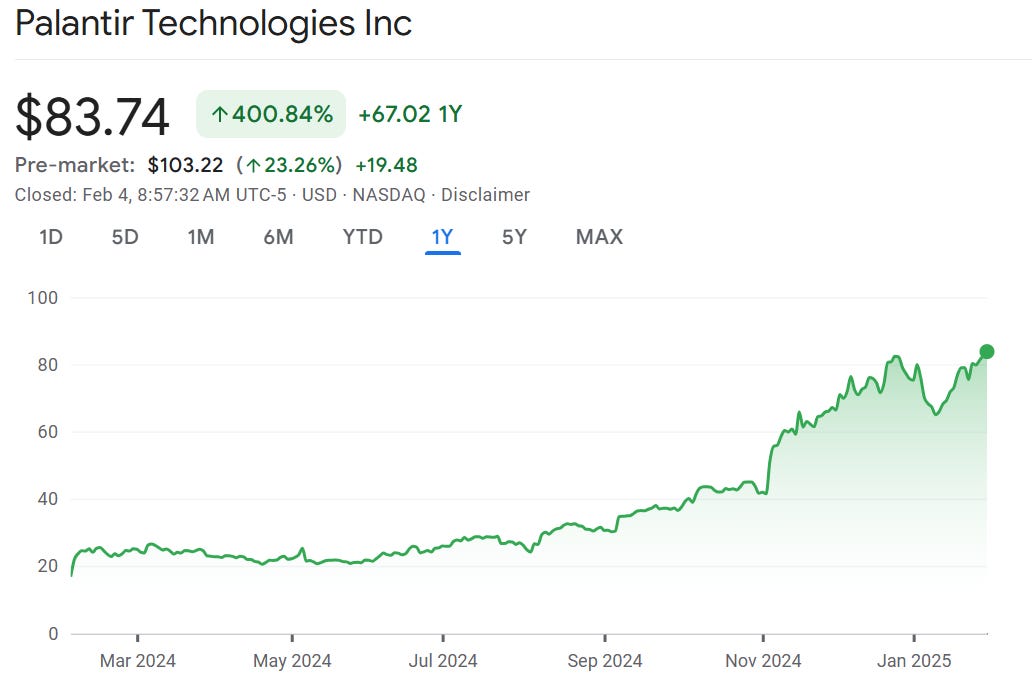

Up & away: Shares of Palantir are rocketing up 24% in the pre-market after sales, profit and its forecast all came in well ahead of expectations. CEO Alex Karp said they are benefitting from “untamed organic growth” for its artificial intelligence software. This morning’s surge comes after the stock put in an impressive 340% gain last year. However, it is not a universally loved stock. Nearly 4% of the shares outstanding are short and there are just 4 buy ratings from analysts compared to 15 holds and 5 sells. The stellar results aren’t causing many bears to change their tune. RBC’s Rishi Jaluria acknowledged the “solid” quarter, but says much of the rally is due to retail investor interest. “…Our concerns about the runway for growth and product differentiation remain,” wrote Jaluria in a note to clients. RBC is increasing their price target to $40/share (half of where the stock is currently trading) and warns that there is downside risk because the stock is trading at a premium. And then there is Dan Ives of Wedbush. He’s got a $120/share price target and says Palantir is playing AI chess while others are playing checkers. “Palantir is helping lead the AI Revolution into the use case phase as its (artificial intelligence platform) product moat is unmatched in our view,” wrote Ives.

Hot spot: Shares of Spotify are up 8% in the pre-market and poised to open at a record high. I don’t know if its a hot new business podcast that is driving results but the company swung to a profit in the quarter and showed a big jump in subscriber growth. Monthly active users now sit at a total of 675 million, which is higher than analyst expectations (677 million). The forecast for next quarter’s sales are a little lighter than expected, but investors are taking comfort in the beat in the fourth quarter. Spotify also has its fare share of naysayers with more than 5% of the shares outstanding short. However, turning in its first year of profit is certainly doing its part to keep them quiet this morning.

Code blue: Shares of Merck are plunging 8% in the pre-market after it forecast weaker than expected profit and sales of Gardasil fell 17% due to weak demand in China. Shares of Merck have been under pressure and are poised to open at the lowest level since 2022 even as quarterly results beat expectations and its cancer immunotherapy drug, Keytruda, saw a 19% increase in sales. Gardasil is a much smaller part of the business compared to Keytruda, but the company announced it was going to halt sales altogether in China for the HPV vaccine and that is weighing on sentiment. Meanwhile, shares of Pfizer are slightly higher after earnings beat expectations and the company reaffirmed its financial forecasts.

X marks the spot: Shares of TMX Group will be in focus after the Toronto Stock Exchange operator beat sales expectations and boosted its dividend 5%. Most analysts are positive on it this morning. “TMX's Q4 results were a solid beat, with strong overall top-line growth offsetting higher expenses,” wrote Graham Ryding of TD Cowen, “Revenue came in ahead of expectations across all revenue lines, with capital formation the biggest surprise (higher-than-expected margin income),” he wrote. Ryding does note that the vlauation is full and has a hold on the stock for that reason. It is one of those stocks that analysts have had a tough time recommending (only 2 buys vs 6 holds) but has continued to move higher and higher.

Your Spotify subscribers quote looks reversed. You say 675 million users higher than analysts expectations of 677 million.