In the Money: 5 Things to Know

Tech is back, General Motors hit by tariffs, Lockheed Martin warns, Bombardier downgraded, homebuilders bounce

The middle of the night is becoming anarchy with the kiddos. Child 1 insisted on sleeping with me taking advantage of her father’s continued quarantine. Child 3 came down twice before I gave in and slept sandwiched between both which is like sleeping between two hot rods that occasionally stab you. Child 2 peed the bed but had the decency not to tell me until the morning. All this to say…I am late. Let’s jump right in.

In this episode of In the Money with Amber Kanwar, we sit down with Canadian hedge fund manager JF Tardif of Timelo Investment Management for an unfiltered, in-depth look at what stocks he’s buying and what he’s avoiding. From why he's keeping equity exposure low despite market highs, to his skepticism around momentum stocks like Opendoor (OPEN) and Tesla (TSLA), Tardif lays out his fundamentally driven strategy in a market obsessed with hype. You can tune in on Apple, Spotify or here.

Make markets magnificent again: US futures are flat after a generally positive session yesterday. The Magnificent 7 is back in the driver seat with the index of mega-cap tech stocks advancing for a 9th session in a row. This is the longest win streak since 2023 points out Jim Reid at Deutsche Bank. But also speaks to market going back to it’s old habit: tech stocks and little else.

Check engine: Shares of General Motors are down about 2% in the pre-market as tariffs took a bite out of profits. Profit took a $1.1 billion hit because of tariffs. However, the company felt confident in offering a profit forecast for the year after slashing it in May. “While the tariff headlines continue to put further pressure on the bottom-line for the foreseeable future, we believe Barra & Co. continues to impressively navigate the complex backdrop successfully while seeing continued high demand for its entire fleet…” wrote Dan Ives of Wedbush.

Mixed bag: Shares of Lockheed Martin is plunging 8% after cutting its profit forecast after taking a $1.6 billion charge on a classified program. The question for investors is whether this is the beginning of more issues with Lockheed’s contracts. Competitor Northrop Grumman, on the other hand, is popping nearly 4% after boosting its profit and sales forecast. It cited demand from its ballistic missile and bomber program which is getting a boost from higher defense spending.

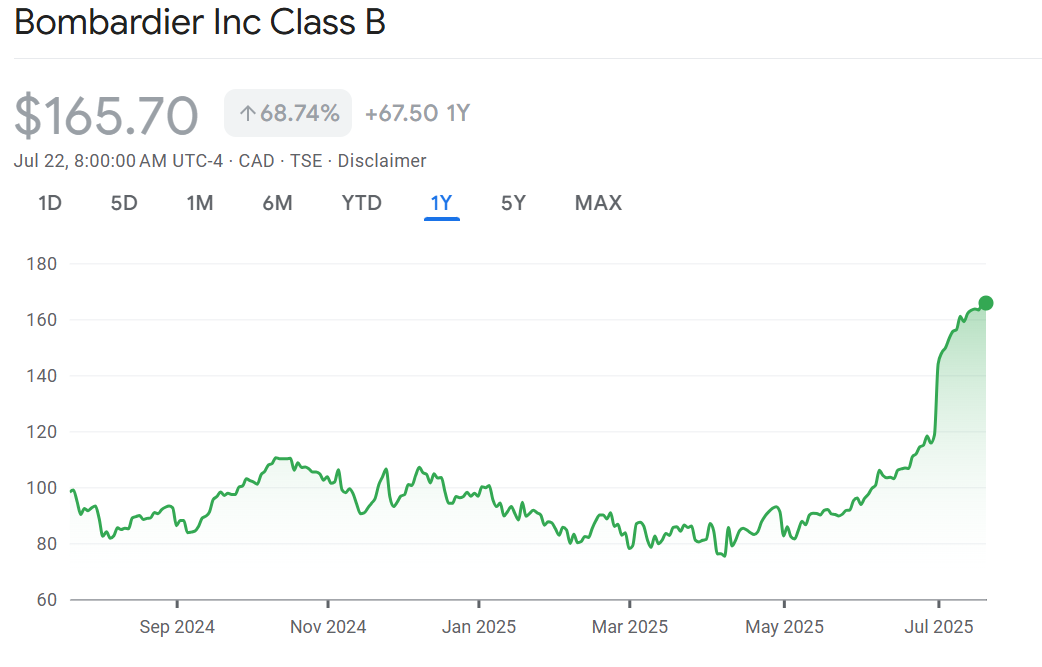

Ringing the register: Watch Bombardier at the open after TD Cowen downgraded the stock to hold. Bombardier shares are up 70% over the past year and that appears the sole reason for the downgrade. “The decision does not reflect our view of the quarter, business outlook, or industry backdrop, but is valuation-based; we believe the recent re-rating is warranted, but further multiple expansion requires time and financial results,” wrote TD’s Tim James in the downgrade.

If you build it: Shares of DR Horton are popping 7% after profit beat expectations and it tinkered with its sales forecast by raising the low end and trimming the high end. The homebuilder warned that conditions for the housing market remain sluggish and that promotional activity will remain elevated. But the stock is down 25% over the last year, so the bar for good news is low. Rival homebuilder Pulte is trading up 5% after beating expectations on the bottom line. Here too there were no signs of demand recovery as sales missed expectations. But perhaps with all these calls for rate cuts, the market is betting that there is an inflection coming.

The housing shortage is slowly worsening. A big rebound is coming eventually. A great contrarian play. That and POOL as well as SWIM for the same reason plus climate change.