In the Money: 5 Things to Know

Futures higher, oil lower, Tesla's robo taxis, Hims & Hers plunges, Fiserv stablecoins, biotech surge

Investors are looking past geopolitics to another big week for the market. Read my weekly preview in The Globe and Mail. For a look at the day ahead, read below!

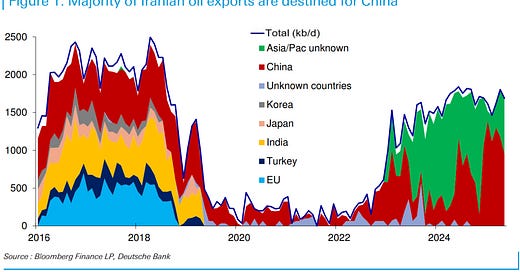

Straight goods: Investors are showing no signs of major panic after the US unexpectedly bombed Iran over the weekend. Futures are actually up and oil is down. The market has decided the conflict will only matter if Iran closes the Strait of Hormuz in retaliation to the US bombing three of its nuclear sites. The Strait of Hormuz is where 20% of the world’s oil supply passes through. Iran’s Parliament voted to close it but investors are waiting for follow through. Closing it would negatively affect their biggest customer: China (see chart below). This puts China in a strategic position to influence Iran’s next move. What happens if it closes? Everyone says higher oil prices and lower growth. Deutsche Bank says such a closure could see a spike up in Oil to around $120/bbl. A closure isn’t the only way Iran could retaliate, writes RBC’s Helima Croft. In the past, Iran has targeted individual tankers or jammed transponders which causes companies to avoid the Strait even if it is open. But investor’s aren’t willing to price in these scenarios this morning: futures are up, oil is actually down while the havens (gold - down, bonds mild rally) aren’t seeing much influx.

If you are looking to bone up on energy stocks, we’ve had a bunch of guests focusing on the sector. Watch the Josh Young and Cole Smead who were on in the last month.

Overshadowed: With all the headlines around the US and Iran this weekend, one might forget that this was supposed to be a huge weekend for Tesla. The company unveiled its much anticipated robotaxis in Austin, Texas. Investors seem satisfied with the event as shares are up about 1.5% in the pre-market. Driverless ridesharing is supposed to be the next mega-catalyst for Tesla and an event with no glitches is being viewed as a positive start. “Today's successful Robotaxi launch is really just the beginning of the Tesla AI story,” wrote Wedbush’s Dan Ives. He reiterated his view that robotaxis will add $1 trillion in value.

Cutting ties: Shares of Hims & Hers are plunging 25% after Novo Nordisk says they will cut ties with the tele-health platform. The company has rode an insane wave on the back of Ozempic and other weight-loss drugs like Novo’s Wegovy. The the stock is up 165% so far this year. This morning Novo Nordisk says they are no longer going to supply them because of “deceptive marketing” and “knock-off versions of Wegovy.” Novo partnered with Hims just two months ago and is a big part of the reason the stock went up. It’s a big win for the shorts, with 34% of the shares outstanding short.

Data surprise: Shares of Exelixis are soaring nearly 20% in the pre-market after its colorectal cancer drug exceeded expectations in a clinical trial. Analysts are optimistic this could pave the way for the drug, known as Zanza, to be approved by regulators. The drug could represent $1 billion in sales, according to Truist’s Asthika Goonewardene. Meaningful considering revenue right now is just over $2 billion. Shout out to Eden Rahim at Next Edge Capital who put this on my radar years ago. It’s been a very fruitful investment!

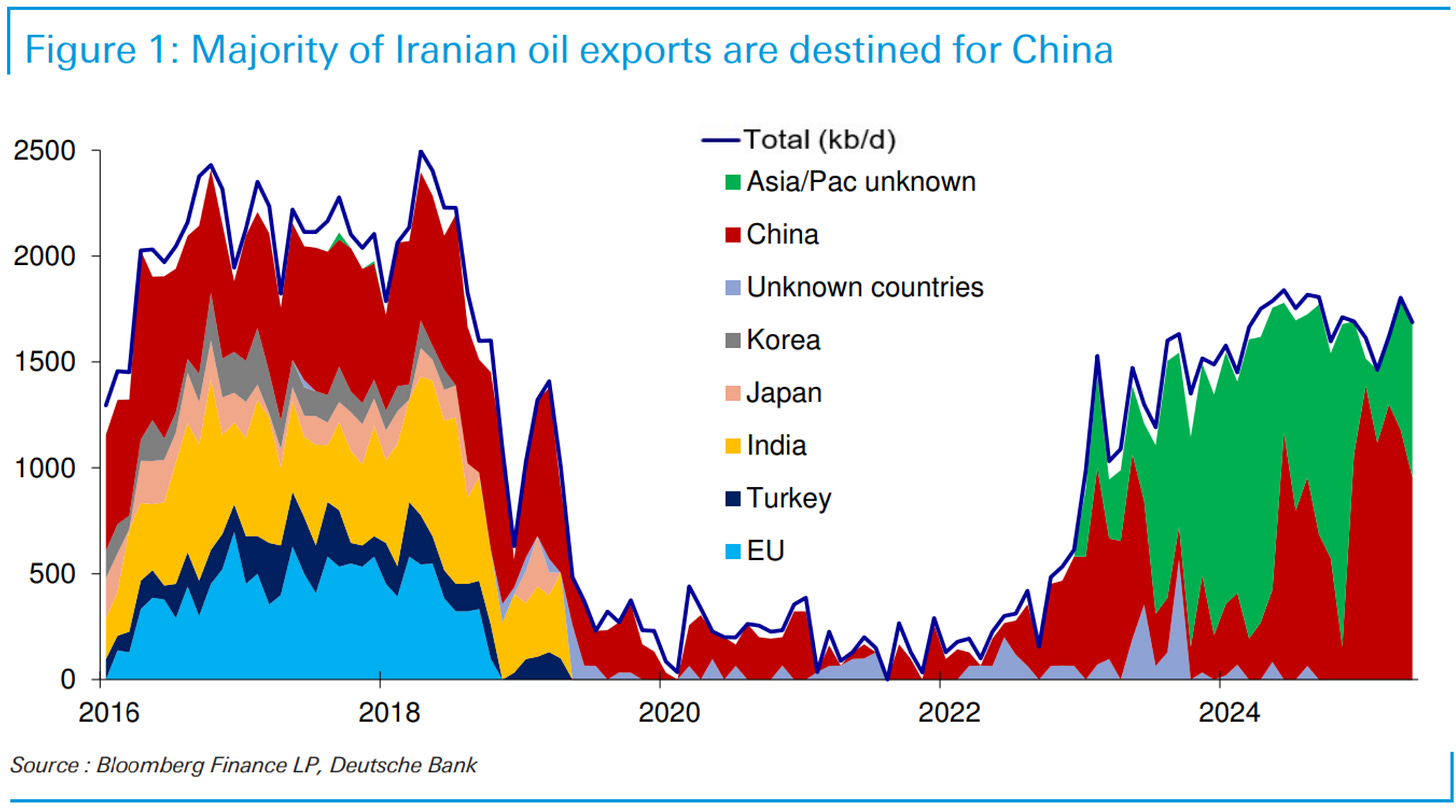

Stablecoins are the new black: Shares of Fiserv are popping in the pre-market after announcing plans to launch a stablecoin and platform for its clients. Stablecoins are cryptocurrencies that are meant to hold a stable value by being pegged to a reserve asset like the US dollar or gold. Ever since US dollar stable coin issuer Circle went public, stablecoins have become the new hot thing. Circle debuted at the beginning of this month and is already up 700% since its IPO. Fiserv is partnering with PayPal and using Circle to launch a stablecoin platform that could be used for its 3,000 regional and community bank customers.