Pro Picks: 3 Ideas for the Changing World

Top investment ideas from James Davolos of Horizon Kinetics

Pro Picks: 3 Stocks to Help You Ride the Global Market Regime Shift

Watch the full episode: Why the Best Fund Manager of 2022 is Betting on Gold, Water, and Infrastructure. Markets are shifting, inflation is sticky, and investors are navigating a new regime. In this episode of In the Money with Amber Kanwar, value investor James Davolos of Horizon Kinetics breaks down the end of easy money, the rise of real assets, and why the next decade will look nothing like the last.

Pro Picks is brought to you by ATB Financial. With $62 billion in assets, ATB Financial is powering possibilities for more than 820,000 financial services clients in Alberta and beyond. ATB's Capital Markets arm is a full-service investment dealer that offers investment and corporate banking, sales and trading, institutional research, and risk management. Visit www.ATB.com/inthemoney for more information

1. Aris Water Solutions (ARIS)

What It Is: A water-handling company serving Permian Basin oil and gas producers, managing produced water and recycling it for reuse or disposal.

Why James Likes It:

Handles 4-5 barrels of water per barrel of oil equivalent, a critical and growing need in the Permian.

High-margin recycling business is expanding, with additional potential in desalination and trace metal extraction (e.g., iodine).

Generates 20% return on invested capital while operating at just 60% capacity, signaling room for growth.

Upside Potential:

Trades at 10x operating cash flow with a 30% revenue CAGR since IPO.

Modest execution could see cash flow grow 20-30% in 18-24 months, potentially doubling the stock price if it reaches a 15x multiple (from $24 today).

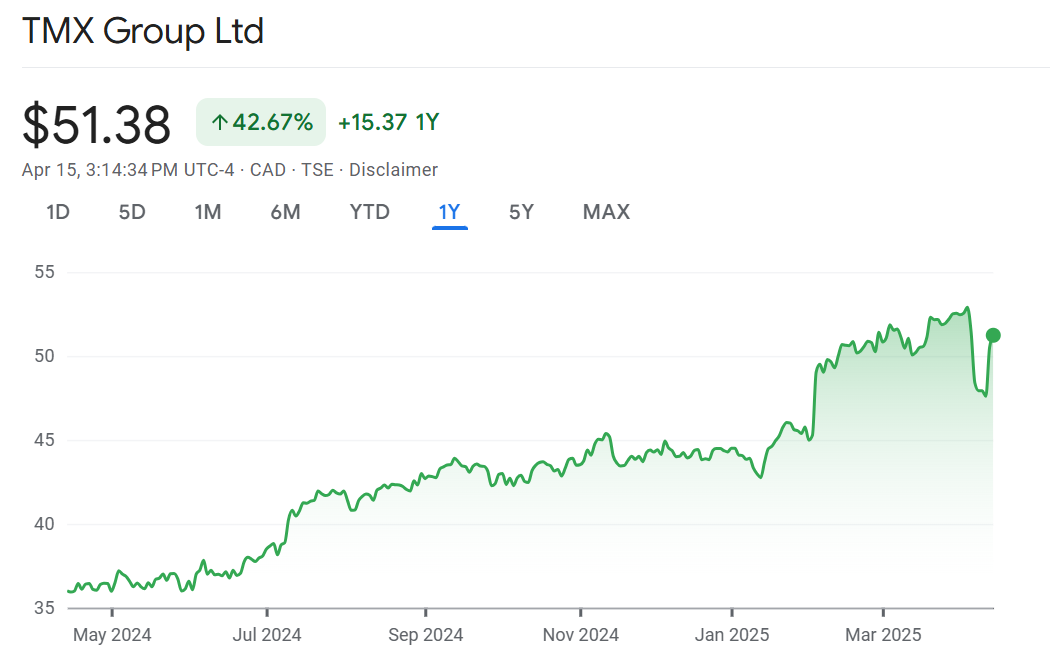

2. TMX Group (X)

What It Is: Operator of the Toronto Stock Exchange and TSX Venture, with a growing focus on derivatives trading, clearing, and data analytics.

Why James Likes It:

Dominates Canadian equity markets with over 65% share in listings and trading.

Derivatives (30% of revenue) via the Montreal Exchange and Trayport (European energy trading) offer high-growth potential.

VettaFi acquisition positions TMX to expand the global ETF market, especially in underdeveloped regions like Europe.

Upside Potential:

Trades at 20x operating cash flow but offers sustainable high single-digit to low double-digit growth.

Bolt-on acquisitions and margin expansion make it a reliable long-term compounder, ideal for steady wealth-building.

3. PrairieSky Royalty (PSK)

What It Is: A royalty company with 18 million acres in the Western Canadian Sedimentary Basin, earning high margins from oil and gas production.

Why James Likes It:

Insulated from oil price volatility with 60-70% margins, unlike producers needing $65-80 oil to break even.

Exposed to ~30% of Canadian energy capex, offering a “free ride” on industry activity.

Structural undersupply in global hydrocarbons (due to underinvestment) supports oil demand growth through 2030 and beyond.

Upside Potential:

Down 27% from its peak, but a supply crunch in 18-24 months could drive oil prices higher, boosting royalties.

Could surpass $30 with a recovery, offering a quality play with a strong dividend for investors seeking safety and yield.