Pro Picks: 3 Stocks to Buy, Hold, Forget

Top investment ideas from Richard Fogler of Kingwest & Co

Fogler’s 3 Long-Term Stock Picks for 2025: Undervalued & Overlooked

Watch on YouTube: Market swings? Tariffs? Recession fears? Richard Fogler doesn’t flinch. In this episode of In the Money with Amber Kanwar, I sit down with the cool-headed CIO of Kingwest & Company to unpack his no-nonsense investing strategy: buy great businesses at a discount—and hold.

Pro Picks is brought to you by ATB Financial. With $62 billion in assets, ATB Financial is powering possibilities for more than 820,000 financial services clients in Alberta and beyond. ATB's Capital Markets arm is a full-service investment dealer that offers investment and corporate banking, sales and trading, institutional research, and risk management. Visit www.ATB.com/inthemoney for more information

Brookfield Corp (BN)

Richard is a big believer in Brookfield Corp, a global powerhouse in private equity and alternative investments. Here’s why he’s holding strong:

Significant Undervaluation: Richard highlights that Brookfield’s stock price is about 33% below its intrinsic value, calculated from its diverse holdings in property, infrastructure, insurance, and carried interest from fund appreciation.

Robust Asset Growth: He notes Brookfield is increasing assets under management by 15% annually, projecting a rise from $1 trillion to $2 trillion in three to four years, signaling strong business expansion.

Why It Can Go Higher: Richard believes the combination of Brookfield’s undervaluation and its consistent growth in assets under management positions it for continued appreciation, as the market recognizes its true value and expansive portfolio.

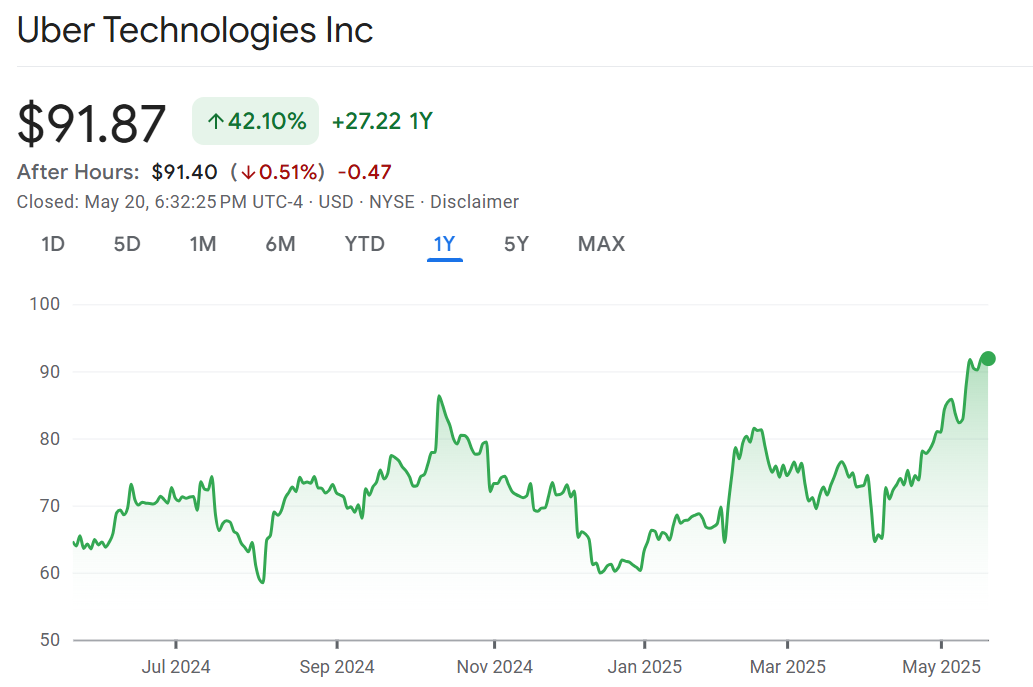

Uber Technologies (UBER)

Uber, a recent addition to Richard’s portfolio, has already climbed 50% in 2025, but he’s confident in its ongoing potential. Here’s what fuels his optimism:

Market Leadership: Uber dominates ride-sharing and delivery, generating $160 billion annually, with a phenomenal business model strengthened by CEO Dara Khosrowshahi’s profitability-focused leadership.

Driverless Opportunity: Richard points to Uber’s deal with Waymo, running high-capacity autonomous vehicles in Austin, Texas, positioning it to thrive in the emerging driverless market.

Profit Growth Outlook: He expects Uber’s profitability to grow 30% annually for the next three years, driven by operational improvements and expansion into autonomous technology, enhancing its financial strength.

SmartCentres REIT (SRU.UN)

SmartCentres REIT, a Canadian retail and residential landlord, is a classic undervalued pick with staying power. Richard’s reasoning:

Stable High Yield: With a 7% dividend yield—uncommon for quality real estate—SmartCentres benefits from stable Walmart-anchored shopping centers, making up 25% of its portfolio.

Residential Expansion: Richard emphasizes its move into high-rise residential projects on zero-cost land, with 94 developments planned over the next 10-15 years, adding a new growth dimension.

Why It Can Go Higher: Richard sees SmartCentres rising as its undervaluation in the “penalty box” fades, supported by its high yield, Walmart stability, and residential projects that boost long-term value creation.

DISCLAIMERS: The information provided in this podcast is for informational purposes only and does not constitute financial, investment, or professional advice. The views expressed by the host and guests are their own and do not necessarily reflect the opinions of any organization or company. The host and guests may maintain positions in any securities discussed on the podcast. Always consult with a qualified financial advisor or professional before making any investment decisions.

I am curious why you continually use US stock listings on Canadian-listed stocks such as BN.TO, BCE.TO, and so on. Given your market being CDN, why not stick to CDN-listed exchanges when they are available?